For this month’s Pulse Report survey — conducted by Baird Research in conjunction with the Marine Retailers Association of the Americas and Soundings Trade Only — 88 dealers responded to our query to assess current marine-retail trends.

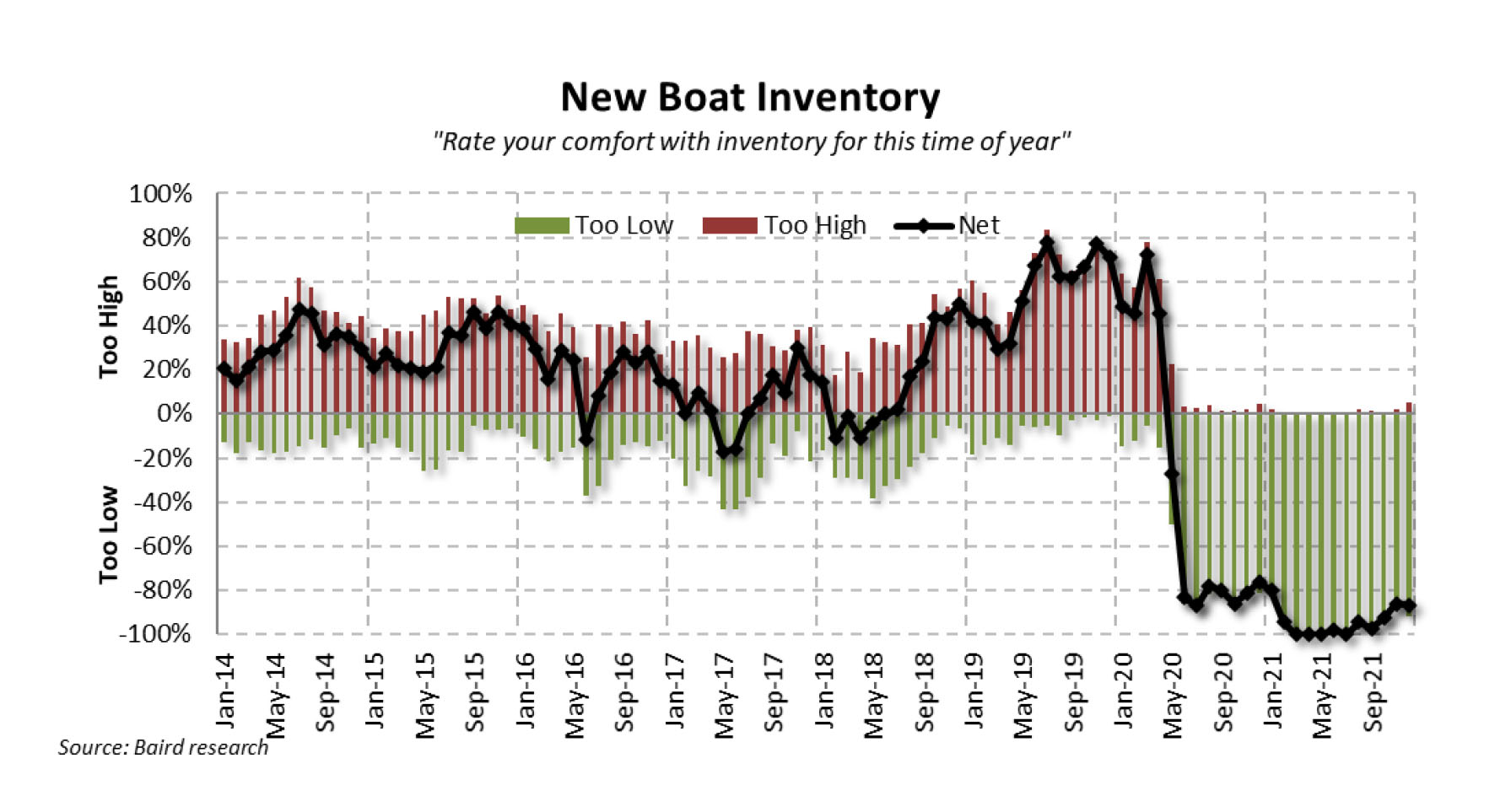

Dealers reported continued strong consumer demand as 2021 ended. Not surprisingly, most respondents also indicated that boat inventory was well below the norm. In a refrain repeated throughout 2021, 91 percent of dealers said new-boat inventory remains “too low.” Used inventory also remains scarce, with 85 percent of dealers reporting that used inventory is “too low.”

This Pulse Report was our last of 2021 — the results were tallied in early January and reflect December 2021 retail conditions — and more dealers reported retail growth (44) than declines (26), an encouraging sign that boat availability may be improving in the lower-volume months of the winter season.

“Inventory on one hand is better, though a majority is sold,” one dealer said. “The issue I see for us is that the partially complete inventory is sitting on flooring while waiting for trailers, parts, etc., that is eating up flooring for stock units … when fully completed units from the factory would sell more quickly.”

Another dealer commented on which models are moving the quickest: “Hottest segment with strongest demand is anything we can get our hands on up to about $500K. Strong demand for larger yachts as well, but nothing compared to sport boats and cruisers, which we are sold out of for all of 2022.” Another dealer said they are “maintaining a strong online presence to stay relevant while inventory is still low.”

Sentiment on current conditions improved, with 59 dealers responding favorably compared with 46 in the previous month’s survey. The three- to five-year positive outlook also increased to 54 versus 44 last month, ending the year on a positive note. “I think the pandemic was great for clearing out excessive inventory,” said one dealer, who then addressed what they foresee as a negative market correction.

“My concern is that when the manufacturers finally get their operations up and running again to deliver stock boats, the market will have lost its demand.”

Dealers are also mindful of the impact of higher costs and inflation on retail demand. “I feel that sales will continue for the dealers who have inventory, but it’s going to be a slower-selling second quarter than a year ago,” one dealer responded, adding that “price increases will be felt throughout the industry.”

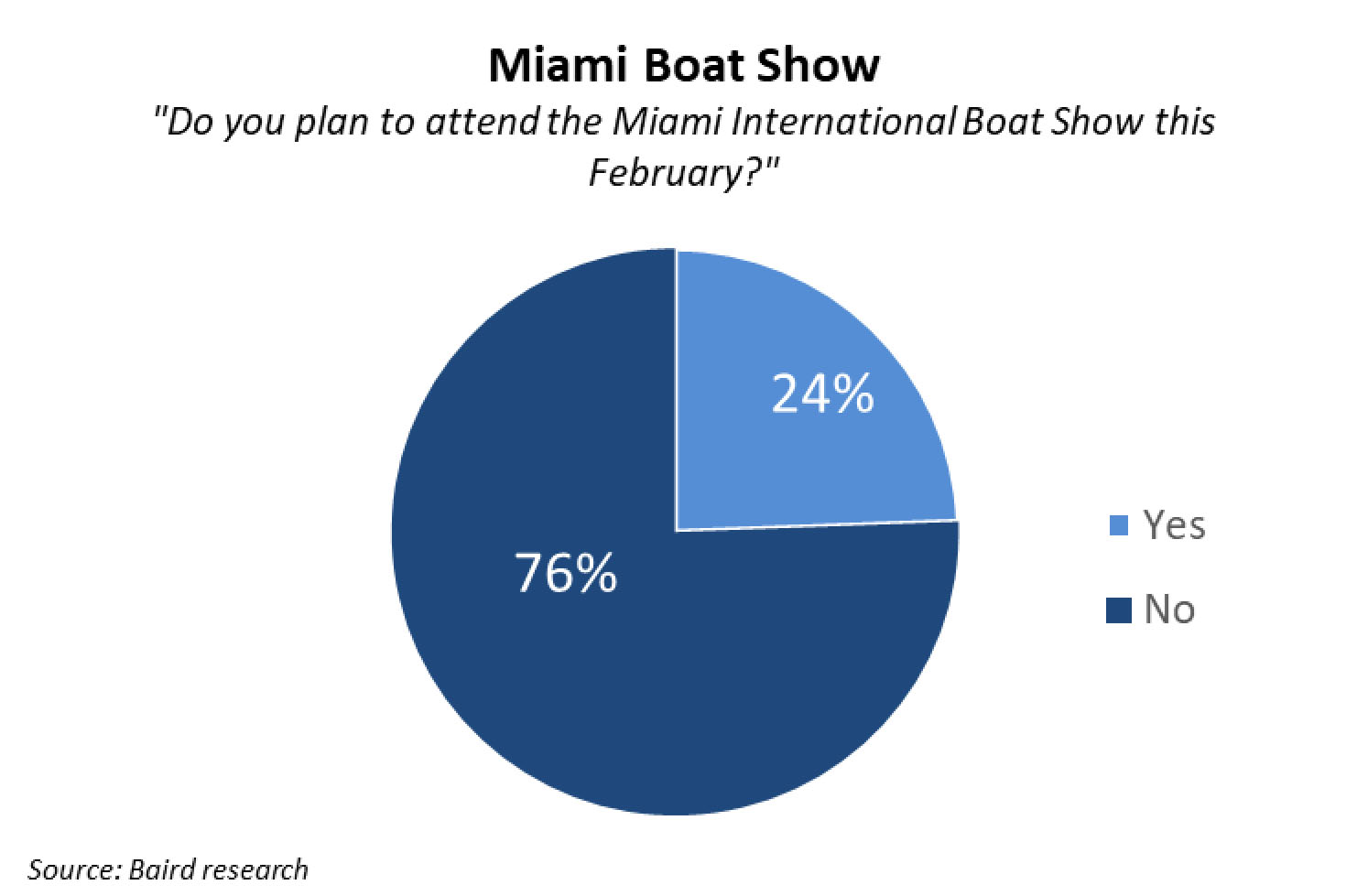

We also asked dealers whether they plan to join the winter boat show circuit and participate at in-person shows. Response was mixed, with some dealers planning to attend the reimagined Discover Boating Miami International Boat Show in February and others saying they’re planning to go to regional shows.

A handful said that they will not attend any shows, citing the lack of boat inventory and pandemic-related concerns. “We are pretty much sold out of 2022 product,” one dealer commented. Another said that in-water shows are the most viable. Another responded, “With the Covid factor, no point in attending as the risk/reward is not worth it.”

Such comments were tempered by positive responses. “Yes, we will attend shows to continue to generate long-term interest in our products.” And, “I am taking my whole company to the Miami boat show.”

Another dealer planning to attend regional shows said “we have to let people know that, in order to get a boat, they have to be thinking about ordering for 2023. Our booth is designed around this concept and making the process easy.”

And one dealer said: “We’ll be attending the Orlando Boat Show in March. Boat shows are our best face-to-face marketing opportunity to meet potential new customers and introduce new products and services while offering new opportunities for people to get on the water.”